UUs for Social Justice (UUSJ) developed an advocacy page "Say No to Fake Tax Reform!" to get UU background on tax reform, talking points and resources. Their letter-writing toolkit "Write Here! Right Now!" can be used to let officials know how our faith and values compel us to seek a more just and sustainable world.

Thursday February 8, 2018

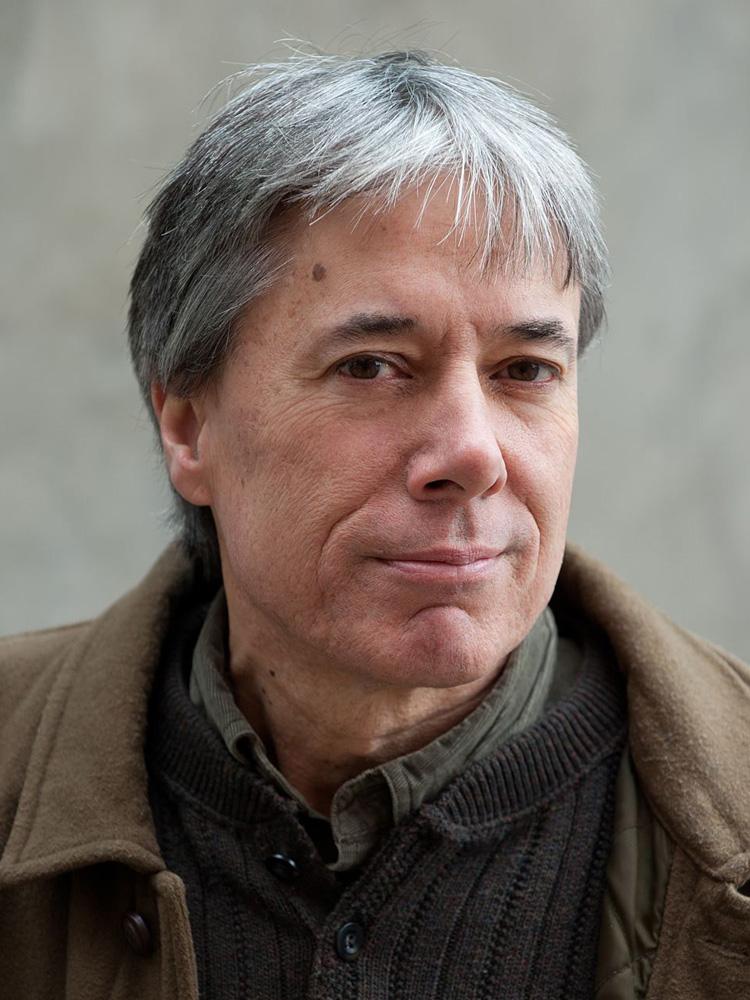

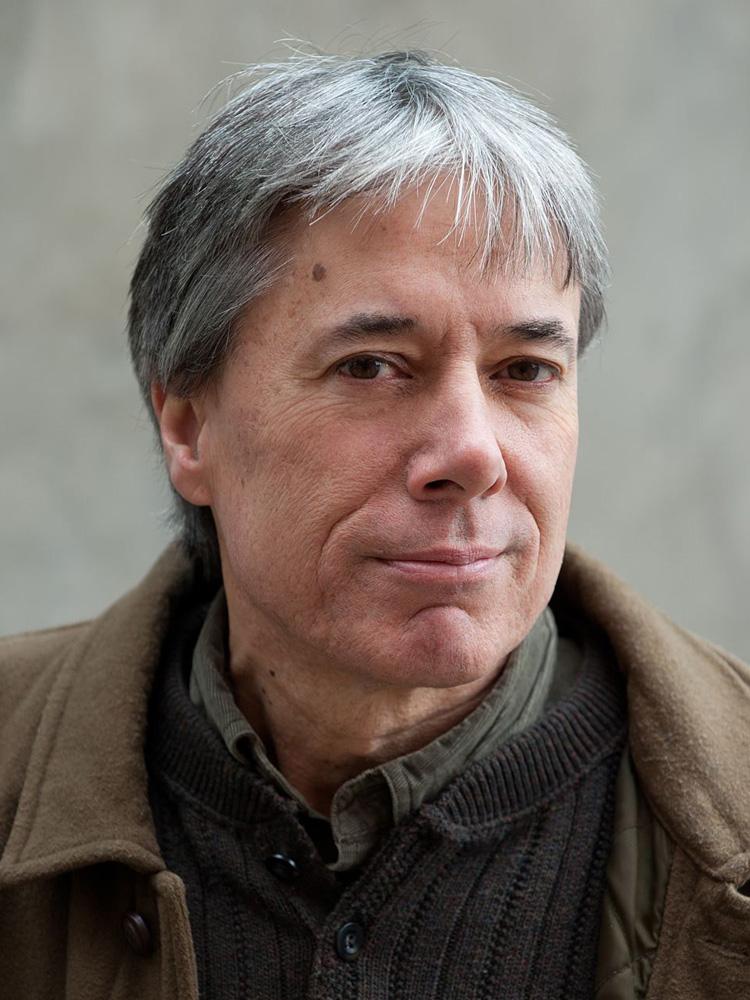

“A Conversation with Chuck Collins”

UUJEC, in partnership with UUs for Social Justice, featured Chuck Collins for our February webinar. As an active member of the UUJEC Advisory Board, we appreciate Chuck’s enduring commitment to justice and equality and welcomed his participation in our webinar series. On the February 8th webinar, Chuck shared initiatives cities and communities are carrying out to reverse inequality; from Massachusetts to California.

UUJEC, in partnership with UUs for Social Justice, featured Chuck Collins for our February webinar. As an active member of the UUJEC Advisory Board, we appreciate Chuck’s enduring commitment to justice and equality and welcomed his participation in our webinar series. On the February 8th webinar, Chuck shared initiatives cities and communities are carrying out to reverse inequality; from Massachusetts to California.

If you missed the webinar, you can view the recording here.

Chuck's new book "Is Inequality in America Irreversible?" is available for pre-order.

You can find "The Community Land Trust Reader" referenced by Chuck, here.

November 6, 2017 Webinar with Will Rice

"Tax Cuts for the Wealthy. Guess who picks up the tab?”

Thank you for attending the UUJEC/UUSJ webinar "Tax Cuts for the Wealthy. Guess who picks up the tab?” presented by Will Rice, Policy Consultant with Americans for Tax Fairness. Will’s presentation slides are available for you to review and share with your congregation here.

To learn more about the tax debate underway in Congress and across the country, please visit the web resources Will provided below. To stay connected with Americans for Tax Fairness you can visit their Facebook page or follow them on Twitter @4taxfairness.

It’s important to reach out to our Senators and Representatives on important issues like tax reform. Elected officials need to hear our voices, our faithful perspectives and our ideas for a more just nation. Please reach out to your Senators and Representatives and tell them: I strongly oppose the any tax bill that gives massive tax cuts to the wealthy and corporations that will be paid for by deep cuts to Medicare, Medicaid, and education.

For more general information on GOP tax plans

To find out how to get involved in the tax fight

To read a section-by-section summary of the House bill as presented by its authors

For detailed outside analysis of the House plan.

Thursday, October 5, 2017

Reversing Inequality with Chuck Collins

Thank you to those who joined UUJEC, UUSJ and our guest presenter Chuck Collins for our latest webinar. Chuck shared information about his newly released report “REVERSING INEQUALITY: Unleashing the Transformative Potential of an Equitable Economy.” The report is an excellent resource to understand the key drivers of inequality and concrete wisdom on how to collectively and legislatively move toward a more just economy. A key takeaway from our discussion was that we must continue addressing the concentration of wealth at the top in order to reverse inequality. Chuck emphasized, that wealth concentration “is the gift that keeps on giving.”

In case you missed the webinar, you can find the video on the UUJEC YouTube page here. Chuck’s conversation with Senator Bernie Sanders from October 3 can also be found here.

Also, Chuck suggested a few action items and points of reference to stay engaged:

- He is speaking at community forums across the country and happy to travel to your congregation. Contact Chuck here.

- Sign up for additional updates at https://inequality.org/

- Participate in the estate tax conversation with the Patriotic Millionaires

- Stay informed on tax policy with Americans for Tax Fairness

- Identify which businesses are the voice for positive change through the B Corp movement.

- Share the events and actions of UUJEC and UUSJ in your congregations.