You probably know that the Social Security Administration collects taxes on just the first $118,500 / year of payroll. You may have also heard that increasing this cap would make the program sustainable for 21 more years. Some say that increasing the cap will result in rich people receiving more benefits. They would, but the balance favors middle class workers.

The Social Security Administration bases monthly benefits on lifetime average indexed monthly earnings (AIME) upon which you paid the payroll tax. Let’s say that Congress increases the cap to $1,000,000 / year. By 2050, a millionaire’s AIME could approach $83,333. (Let’s ignore inflation for simplicity.) The current formula produces a monthly benefit of $2,712 at age 66 and $3,580 at age 70. With a $1,000,000 cap, the millionaire collects $13,700 at age 66 and $18,100 at age 70.

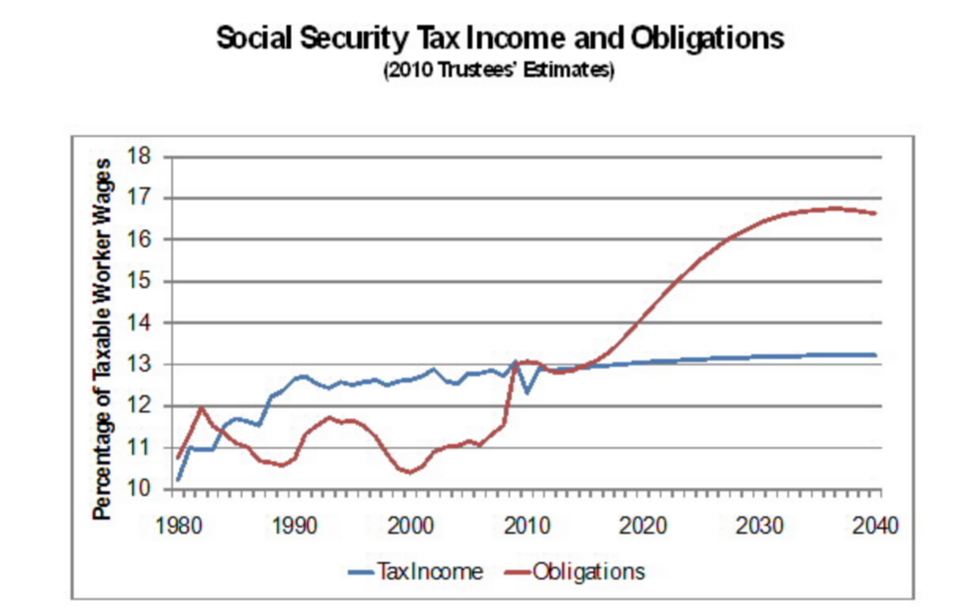

Image from Economics21 article cited

Here is why this huge benefit is okay: Between 25 and 70, this millionaire puts in $5,580,000 (including the employer share). Between 70 and 92, he or she collects $5,864,500. Over the same duration, a person who makes $46,500 / year pays $260,000 and collects $562,500. This change creates a stronger Social Security program because millionaires pay more for each dollar of benefits. [Kit Marlowe, Membership Committee]