The duty of a financial advisor to the client can be confusing. Many individual investors, seeking help among an often-confusing array of investment choices, go to financial advisors for help. These advisors have many titles, and more importantly, a wide variety of obligations to their clients. However, only those financial advisors with a Fiduciary responsibility must act in the best interests of their clients.

Other financial advisors are at times only salespeople who often recommend investments providing them with big commissions without providing clients with investment that are in their best interests. This confusion in titles and responsibility has led to billions of dollars being lost by investors. Both Senator Tammy Duckworth and Syndicated Columnist Chuck Jaffe have written recently about this issue as well.

The Dodd-Frank Act sought to protect the clients by making financial advisors operate under a fiduciary duty. Without a fiduciary duty, a financial adviser could sell clients a stock which would place their investments at significant risk to produce a sizable commission for themselves. With a fiduciary duty, the financial adviser is required to place the client’s interests before his/her own. This section of the Dodd-Frank Act is set to go into effect April 10, 2017.

The Dodd-Frank Act sought to protect the clients by making financial advisors operate under a fiduciary duty. Without a fiduciary duty, a financial adviser could sell clients a stock which would place their investments at significant risk to produce a sizable commission for themselves. With a fiduciary duty, the financial adviser is required to place the client’s interests before his/her own. This section of the Dodd-Frank Act is set to go into effect April 10, 2017.

President Trump issued an executive order directing the review of the regulations contained in the Dodd-Frank Act. The mandated review includes the consumer protection provision of the Dodd-Frank Act, which makes the financial advisor operate under a fiduciary duty to the client. There is a high probability that come April 10, 2017, the consumer protection provision of the Dodd-Frank Act will not take effect.

We are concerned for the clients of financial advisors. Unless the rule goes into effect, advisors may not be obligated to have the client’s best interest in mind. As the law currently stands financial advisors are operating under the "suitability standard". This standard merely requires the financial advisor ensures an investment is suitable for a client at the time of the investment. This isn’t much protection.

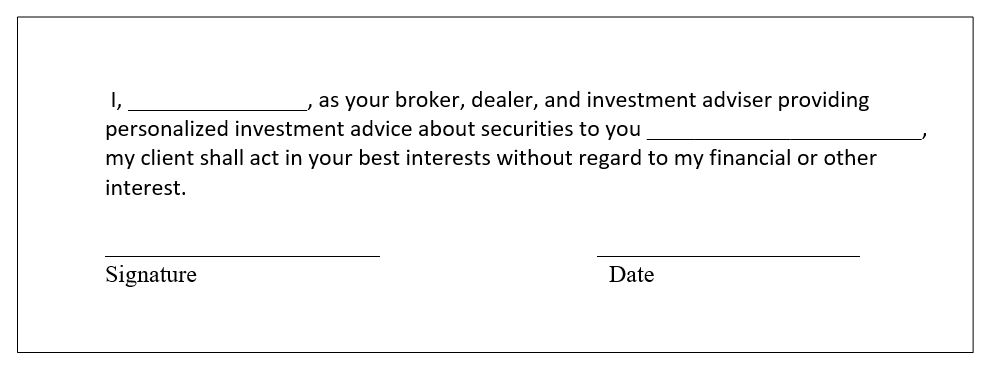

To provide some protection for clients of financial advisors, we have drafted a sample text clients can ask their financial advisor to sign. This example is below. The language is taken directly from the Dodd-Frank Act so if this administration removes the consumer protection provision from the Dodd-Frank Act, it’s still possible to secure the protection the Act sought to provide.

We are not offering legal advice. The is an example of a possible agreement between a client and financial advisor. If your financial advisor won’t sign an agreement of this nature, it may say something about your financial advisor.

Jim Black, UUJEC Board Member, on Behalf of UUJEC